There’s a lot to like in the Pensions and Lifetime Savings Association’s “Hitting the Target” report. But there are also a few things we wish had made it in there.

So we thought we’d write down our thoughts and share them with you. Please let us know what you think. Oh, and one small thing – please don’t think we are criticising what we think is a great and important effort. We are just seeking to add to the discourse and improve on what is already a great start.

What we like

The report has started a debate on something that affects us all.

That alone makes this document a huge success. Its existence will make others talk, respond, change practices, change products, and more. And that’s a very good thing.

It frames the problem correctly… Well, nearly

The report frames the problem as an adequacy challenge – generating enough income in retirement to meet one’s expenses in retirement. It touches on the impact of longevity, health care, long term care, housing affordability and costs. We agree.

It considers the self-employed

We often wonder why auto-enrolment excluded the self-employed. We’re glad this report doesn’t, and that it makes specific suggestions about taking care of them. After all, there are 5 million self-employed people in the UK and that figure is growing.

It considers the importance of stable taxes on retirement income and pensions

Buy-to-let properties became popular retirement income vehicles because of the tax benefit. When buy-to-let mortgages lost their tax benefit, a number of pensioners saw their retirement incomes shrink unexpectedly. The report makes it clear that the government needs to consider the unintended consequences of increasing tax rates or abolishing tax breaks, in effect robbing Peter to pay Paul. That’s really important.

We all face enough uncertainty in our futures without the government adding even more.

It considers the role of property wealth in funding retirement

Elsewhere in the report, we read that the next generation may have less property wealth than the last. This is bad news. But at least this topic is discussed and the report makes good suggestions.

It considers the role of working past “retirement”

It seems every other day there is some kind of report that says we should keep working into old age to ensure our minds stay sharp and we promote good health. Meanwhile, the government keeps increasing the retirement age.

We’ve often wondered who exactly is going to employ an entire generation of people in their late 60s and well into their 70s. The report doesn’t answer that question. But it does flag the issue of working into retirement.

It tips its hat to passive action

As with auto-enrolment before it, the report understands that inertia is a powerful force of nature. So it describes proposals that involve the end consumer doing absolutely nothing and yet improving future outcomes.

What we wish was in there

There’s a lot we wish the PLSA working group had considered. Here are a few thoughts.

A few “table-stakes”

Two things seem rather obvious to us.

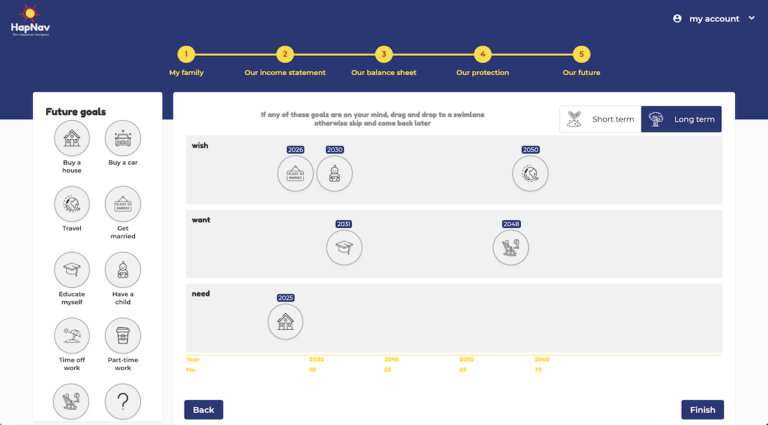

The first is that having a number of small pension pots lying all over the place isn’t good. The second is that being able to see all your finances – including your pensions – together in one place is good. Neither the Pensions Dashboard, nor Open Banking goes far enough in this regard. Such a feature is an enabler of other helpful features, like the ability to keep consumers on track.

The report doesn’t talk about either of these things. We wonder why.

More about the “nasties”

There’s no question we’re all going to be spending much more on healthcare and long-term care during our lifetimes than our parents did. The report touches on this, but we wish it had dug deeper. If you can’t quantify a problem, you can’t solve it.

We believe a good planning framework must help people understand these issues using available data and sensible assumptions. On that front, we love the Vanguard/Mercer report on “Planning for health care costs in retirement” and believe much of what it says applies in the UK too.

We would like to see the financial services and healthcare industries design better and cheaper solutions to help people protect against these “nasties”, and we will do what we can to help.

This will then help answer the question “How much is enough?”

The role of things other than saving and investing

A wise woman once said: “The man with a hammer should be forgiven if everything looks to him like a nail.”

Our experience – and the hard numbers – tell us most people will need to rely on insurance and “wise” borrowing to achieve the future (and the retirement) they aspire to. Saving into a pension and investing in the markets are important, but they won’t be enough.

Likewise, we believe people need help to understand their choices and trade-offs, not only the financial ones but also (non-financial) life choices that can impact their financial futures.

Our experience tells us that if you frame the solution in terms of “save more, spend less”, it is likely to fall on deaf ears.

The affordability dilemma

For most people in their 20s and early 30s, sacrificing the kind of income figures indicated in this report simply isn’t realistic. It isn’t safe to assume that because the young didn’t opt out when the figures were tiny, they won’t opt out as those numbers increase and their take-home pay is truly pinched.

The report touches on day-to-day expenses that are spiralling out of control, like the cost of owning or renting your home, the cost of higher education, the cost of decent health care (beyond what the NHS can provide) and long-term care.

What it misses, in our view, is that the “retirement challenge” is in fact a problem of meeting uncertain future expenses over an uncertain time frame with uncertain income sources and assets. Underneath the adequacy challenge sits a much bigger monster – the uncertainty challenge.

Our experience tells us we need to look well beyond income to solve this problem. We need to rethink the role of insurance, “wise” borrowing and the state support mechanisms. And we probably need to think of a “glide-path” on retirement contributions during one’s working years instead of the current flat-line approach.

That’s why the Envizage methodology simulates uncertainty on both sides of a household’s finances: what comes in and what goes out, plus what it owns and what it owes. And that’s why we boil down the choices to a set of real-world actions that people can understand, engage with, and put into practice.

The importance of means-testing

The report talks a lot about Australia.

Australia has a means-tested state pension, which means those who can afford to live without some or all of it will do so. If the UK considered something similar for our state pension and our NHS, it may make a lot of other important stuff more affordable for a lot of other people. That’s worth a serious look.

Most people in the top half of wealth and income would probably be happy to pay a tenner for a GP visit. That alone may make it easier for the NHS to serve us all in the years to come.

Numbers don’t engage; and words even less so

We think any attempt to get people to engage with their future outcomes needs to be focused on emotions, and not on rational or logical pathways. Yet another “retirement savings calculator” isn’t the answer. Neither is a bunch of reading material aimed at “financial literacy”. We all know literacy and numeracy are serious problems in the UK. More numbers and words are not going to help.

Push-me-pull-you

Some actions have unintended reactions. If employers feel their contributions are so high that they affect profitability or solvency, they will hire fewer people or let people go more easily when things turn sour, which creates another potentially bigger problem for society. Auto-enrolment may just work because it requires the consumer to do nothing. But we worry the affordability challenge may lead to more people opting out as their contribution rates rise into the teens.

Don’t let the tail wag the dog

In our view, guided at-retirement decisions must focus on more than just the pension pot. They must take a much more holistic view of sources, uses and uncertainties. They must account for the fact that for most people, their pension pot is going to be a small source of how they pay for their later years.

And so …

We admire what the PLSA and steering committee have set out to achieve with this report.

This is a massive and important problem that can harm future generations if we fail to address it. The PLSA are on the right lines, even if we do wish they had gone much further. That said, we know it isn’t easy to align so many different opinions, and as a result, committees can sometimes deliver watered-down outputs.

We see this report as a solid start to what needs to be an effective and collaborative long-term effort across financial services, technology and policy-making. This is essential if we’re to put a dent in the challenge of uncertainty and give future generations the best chance at success.

We are delighted to have been invited by the Chartered Insurance Institute to contribute to its “Insuring Women’s Futures” initiative. We’ll use this invitation to share some of the ideas and suggestions above, and to move them from concept to action.

How Envizage can help you and your customers (or members)

We’ve built Envizage’s holistic advice engine to help people everywhere understand the risks and uncertainties that lie ahead, and to help them make more informed choices to improve their future.

Our engine is holistic. This means it considers the big sources of uncertainty to our future that we can anticipate and protect against. It also means it considers the many different ways in which we can prepare for and protect against these uncertainties. Some of these are through financial products and solutions, and many others aren’t.

Our engine can provide advice. This means it thinks through various ways a household can improve or achieve its desired future. It lets the household play with and visually explore these choices and trade-offs, to decide which are right for them.

Specifically in the context of the PLSA “Hitting the target” report, our engine can help clients deliver its engagement recommendations via a truly holistic “Mid Life Financial Health Check” that can drive repeat visits over time.

Thinking about long-term futures can be boring for some. It can make others anxious. With Envizage, it doesn’t have to be that way. We help our clients create unique, engaging and – dare we say – fun user experiences that help their customers and members understand and improve their futures.

[vc_separator type=”normal” border_style=””]

To learn more about how Envizage helps banks, insurers, assets managers and pension funds better serve their customers and members, contact-us@envizage.me