Envizage, the holistic advice engine, has been authorised by the FCA as an account information service provider (AISP) under the EU Second Payment Services Directive (“PSD-2”).

This status enables firms using Envizage’s technology to aggregate information from their customers’ bank and other financial accounts under Open Banking regulations so they can review their balances on a daily basis, providing them with an overview of their finances at any time in one place.

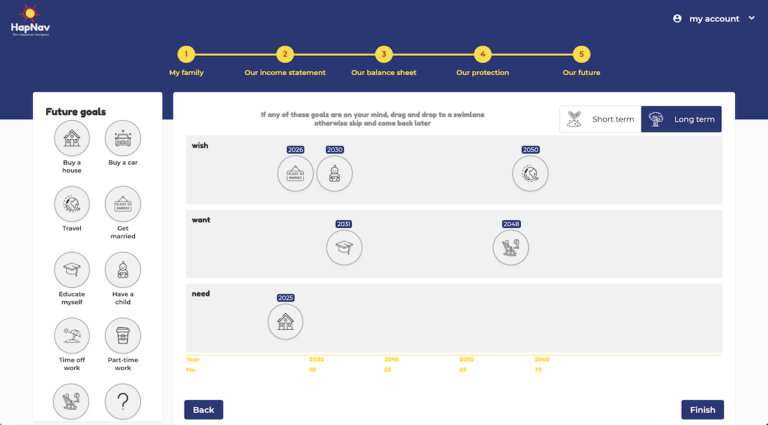

As well as banking data, such as household balance sheets and income statements, Envizage considers information on insurance cover and desired outcomes, then factors in risks, such as inflation, financial market fluctuations and the potential for poor health or disability, and models hundreds of potential ‘lives’ to generate next best actions.

The firm says the authorisation means their clients – including banks, insurance companies, retail wealth managers and pension funds – can continue to collect and present information in a way that makes it easy for customers to understand and improve their financial future.

Vinay Jayaram, founder and CEO at Envizage, said: “The future of financial services is about integration of information and services.Open Banking provides a huge opportunity for our financial services clients to help their customers achieve better future outcomes and improve their financial resilience.

“Our FCA registration – the result of rigorous testing of our security and data-protection systems – means our clients will be in a position to offer their customers a more holistic overview and greater control of their finances.”