Table of contents

Example 1: Using Envizage to deliver guidance

Example 2: Using Envizage to deliver advice (a personal recommendation)

Summary

Envizage partners with banks, insurance companies, asset managers and wealth managers to create unique consumer-facing applications powered by its analytic platform. Envizage’s mission is to enable individuals and households to understand and better manage the financial uncertainties in their future.

Most consumers in the U.K. lack the confidence to make important financial decisions. Yet most digital financial-services offerings in the U.K. today target confident consumers. Envizage allows financial services firms to convert less-confident consumers into high-intent customers willing to go on a digital journey that leads to a product purchase or financial transaction. Envizage also allows financial services firms to prove to their regulator that, based on the information provided by the consumer, the financial product sold to a consumer is not only suitable and appropriate for the consumer’s current situation, but is also compatible with their desired future outcomes. It does so by modelling the future of the consumer and their household in a realistic and complete way, including the main elements of uncertainty in that future.

Through examples, this document outlines how a U.K. financial services firm can use the Envizage platform to deliver either:

- Guidance leading to self-directed “execution-only” solutions; or

- Advice leading to a personal recommendation

whilst in each case complying with relevant FCA regulations and guidelines.

Introduction

New technology has the potential to empower individuals to take more responsibility for their own financial futures. It can enable financial services firms to more accurately identify consumers’ needs and more effectively deliver on their desired future outcomes.

The FCA has recognised the need for consumers to have access to appropriate, affordable advice and guidance at all stages of their lives. Financial services firms need to show consistently that the fair treatment of customers is at the heart of business models, and that they can deliver on the six key customer outcomes (1). Firms must ensure their customers can see the potential impact of financial decisions on their desired future outcomes before they transact.

The Financial Advice Market Review (FAMR) intended to help close an ‘advice gap’. It was widely agreed that technology could reduce the cost of advice and help develop new ways to engage mass, mass-affluent and affluent consumers. Deloitte, in its research ‘The Next Frontier – The future of automated financial advice in the UK’, found that up to 15 million U.K. adults would be willing to pay for automated advice. However, during the Review, many respondent firms stated they did not feel able to develop streamlined advice services to meet simple consumer needs.

Following the FAMR, the FCA is encouraging the development of automated advice. To close the advice gap and reach millions of neglected consumers will take a combination of (a) advice leading to a personal recommendation, and (b) guidance leading to self-directed “execution-only” solutions, whilst in both cases complying with FCA regulations.

A hybrid approach delivered through the platform acknowledges that some individuals may just need guidance, and that others may need the additional support of a full advice service. It allows for the reality that consumers tend to seek advice at specific trigger points in their life or when they have a specific need. Such triggers could be buying a house, putting children through university or planning for retirement. It also acknowledges that many people do not have the time nor the knowledge to make sense of financial services and products.

The Envizage analytic platform lets consumers see their future in a visual, intuitive and realistic way. Consumers can use it to make wiser, more informed decisions without needing to understand finance. Financial services companies no longer have to push generic products to the consumer. This technology is designed to help consumers plan their finances around their lives, not build their lives around their financial products. Envizage aligns the financial services industry with its customers and their desired future outcomes.

We describe through examples how the Envizage platform can be configured to deliver either guidance leading to non-advised (i.e. self-directed) execution or automated holistic advice leading to compliant personal recommendations from a restricted solution set.

Example 1: Using Envizage to deliver guidance

Responding to a marketing e-mail from her bank, Sally decides to try out the bank’s new mobile application, powered by the Envizage engine. She downloads and installs it from the App Store.

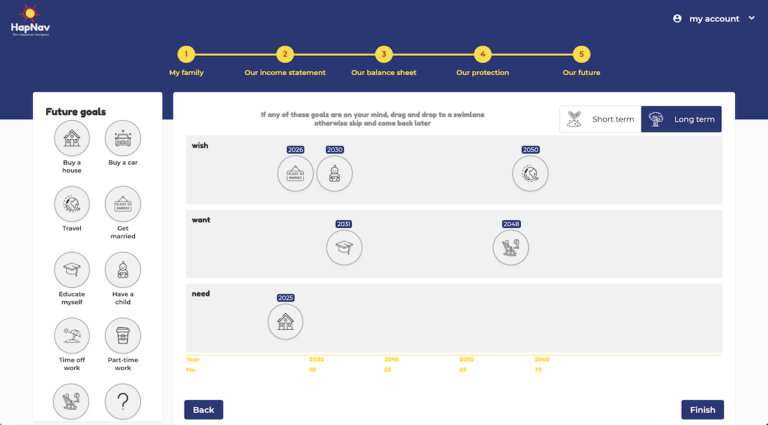

At first, Sally inputs just five pieces of data – her year of birth, gender, annual household income, monthly household expenses, and total savings. She then identifies and adds a few of her desired future outcomes from a selection: in her case, she and her partner would like to buy a home in two years’ time, they would like to have their first child when she is 30, and she dreams of retiring when she is 55. She assigns each outcome a relative importance: essential, important, or nice-to-have.

She runs the simulation for a first time. Using a patented Monte Carlo method, the Envizage engine simulates the future of her savings and investments, as well as certain life events – death, illness, disability, and long-term care – over Sally’s lifetime. The simulation is based on her bank’s chosen economic, capital markets, and actuarial assumptions, and on the limited information she has provided.

Encouraged to see that some outcomes look achievable whereas others need her attention, Sally notices that her profile is incomplete. She adds her partner Joe, his year of birth and his income, and refines her initial inputs to add a bit more information on her household debt and their joint savings and investments, including their employer pensions. They have no property or insurance at present.

Then she runs the simulation again, and sees that the likelihood of her desired future outcomes have changed in response to the new information. She adds a new future outcome – she and her partner would like to be debt-free within the next five years. She is asked if she would like to save her details and scenarios securely, which she does.

She then sits down with Joe. Together, they click on and explore each future outcome and are shown their next best action to improve its likelihood. Underneath the hood, the Envizage engine runs thousands of simulations and calculates the impact of various possible actions on Joe and Sally’s desired future outcomes. The action with the greatest impact on the outcome is presented to them as their next best action.

Through this self-directed journey of exploration Sally and Joe discover that their future outcomes improve materially when they add £250,000 of joint term-life insurance, change their investments from cash to a 50:50 mix of cash and stocks, delay Sally’s retirement by a few years, wait a year to buy their house, and maximise her tax-efficient savings (by using an ISA).

When Sally feels confident about her next actions, she is presented with three choices for each of the financial products she and Joe have concluded they will need. Open Banking has made it possible for her bank to offer not only their own products, but also other products available in the market. Sally is pleased with this experience, which she perceives as transparent and trustworthy. She proceeds to purchase a joint term-life insurance policy from one of the providers with a sum assured of £250,000 and to open an ISA with her bank. She chooses her bank for her ISA because of the relative ease of doing so. She chooses the insurance provider because they do not require medical underwriting for her case.

Before she takes these actions, a splash-screen confirms to her that her bank did not provide her with advice, since the bank did not recommend any of those products to her as being suitable or appropriate for her or her partner. She clicks “OK”, then continues on her self-directed purchases of a stocks-and-shares ISA and a term-life insurance policy.

Sally’s user journey is not advice, which “requires an element of opinion on the part of the adviser. In effect, it is a recommendation as to a course of action. Information, on the other hand, involves statements of fact or figures” (PERG 8.28). All examples can be seen in PERG 8.23 – PERG 8.27.

For advice to be regulated at all, it must relate to a specific investment and must be given to the person in their capacity as an investor or potential investor. It must relate to the merits of them buying or selling the investment. Direct examples from the FCA include:

- Providing advice to a customer to buy shares in XYZ plc or to sell Gilts 10% 2014 stock is advice about a specific investment – regulated.

- Advice to buy shares in the energy sector or shares with exposure to a particular geography is generic advice because it does not relate to a specific investment – not regulated.

- Advice on whether to buy shares rather than Gilts is generic advice – not regulated.

- General advice about financial planning is generic advice – not regulated.

Example 2: Using Envizage to deliver advice (a personal recommendation)

Sally and Joe go on exactly the same digital journey as above. As they get ready to act on the discoveries they have made through their exploration, they are presented with two options: “I’m confident: I’d like to proceed without advice”, and “I’m not sure: I’d like to seek advice before proceeding”.

If they select the “advice” option, they again have two choices: they can connect with an advisor for a face-to-face or video session to review and fine-tune their conclusions, or they can continue with the digital experience. In each case the result is a personal recommendation for Sally and Joe.

If they choose to stay with the digital experience, they must add more information so that Envizage – and the bank – knows enough about their specific circumstances to provide a personal recommendation for that particular solution. When their profile is complete, the status light changes from red to green, indicating that the bank is now able to provide them a personal recommendation. This supports delivery of COBS 9 “Suitability”. The information collected also allows the bank to create required documentation such as the “Statement of Demands & Needs” and Suitability Reports.

For example, if Sally and Joe are seeking term-life insurance, they may be asked if they are currently in good, average or poor health, and if they have certain pre-existing conditions. If they are seeking a mortgage, they may be asked to link their bank and credit card accounts so their expenses and credit standing can be verified. These personal recommendations may come from amongst the bank’s own products, in which case a clear message will indicate to Sally and Joe that this is restricted advice.

In the case of savings and investments, note that they have already specified their Risk Tolerance (delivering COBS 9A.2), which they expressed in terms of the importance of each of their desired future outcomes on a scale of essential, important, or nice-to-have. In other words, they are willing to take some risk of not being able to achieve their “nice-to-have” outcomes, but they do not want to take any risk of not being able to achieve their “essential” outcomes. They have seen through the app experience that investment risk affects their desired outcomes. For example, moving the “investment risk” slider higher improves the likelihood of achieving their desired retirement outcome. They can also see that the higher the investment risk, the greater the size of a negative outcome.

They have also specified the timeframe for each outcome by indicating when in the future they would ideally like to achieve that particular outcome. Some outcomes, like retirement or buying their first home, are flexible in time, whereas others, like educating their children, must happen on a specific date.

And finally, when Sally re-runs the simulation, she notices that even in a worst-case scenario – which is caused when bad markets and bad life events happen at the same time – her essential outcomes still look fine. This tells her that she and Joe have an adequate ability to bear losses. (If this isn’t the case, Envizage will inform her that her next best action is to reduce the investment risk she is currently taking, or pay back her expensive student loans before exposing their savings to investment risk.)

To ensure that Sally and Joe continue to benefit from the bank’s “advice” in the future, they can connect all their financial accounts and grant Envizage permission to monitor their situation in the background. On the 15th of each month, Envizage will update their financial account data, with their permission, and re-run the simulation. If everything is fine, they will receive a notification to this effect. However, if one or more of their desired future outcomes is no longer looking as achievable as it was at the last update, they will receive a different notification. They will be told which outcome is at risk, why it is at risk, and what their next best actions are to improve that particular outcome. Once every so often, they will be invited to verify their circumstances and confirm that their desired future outcomes are still valid.

This ensures that their information is kept up to date, and the digital advice remains current and FCA-compliant.

The Envizage-powered application is able to support a firm’s compliance with all regulatory requirements within the FCA / PRA Handbook and able to be configured specifically with all requirements within COBS, from COBS 2 (Conduct of Business Obligations) through to COBS 9 & 10 (Suitability and Appropriateness).

Conclusion

Through two user cases this paper has demonstrated how Envizage can power guidance or advice journeys in a way that fits with the FCA’s current set of regulations and recommendations. It can also transition between guidance and advice seamlessly.

The platform can be used to power a consistent, repeatable, auditable holistic advice process. It can be delivered through advised, digital-only, and hybrid channels. It can uncover needs and drive solutions across banking products (mortgages and loans), savings and investment products (ISAs, SIPPs and simplified investment portfolios), and protection products (annuities and various forms of insurance). And best of all, it can be used to create engaging user experiences that focus on outcomes rather than money.

To expand their customer bases, financial services firms need to be able to serve not just those consumers who are confident and know what they want. They must convert those people into customers who are unsure of their needs or what they are looking for from financial services. The Envizage platform allows financial services firms to convert less-confident consumers into high-intent customers.

The Envizage engine satisfies the requirements set forth by the FCA, and our clients can easily comply with today’s regulations by using the Envizage platform to power their customer journeys across advice and guidance.

For more information please visit envizage.me or contact-us@envizage.me

May 2018

Orwell Digital helped in the creation of this paper, with regulatory input from Cindy Eves. Cindy is an experienced regulatory consultant with over 15 years’ experience advising U.K. financial services clients on regulatory projects and matters related to the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA). For further questions, Cindy can be reached at cindy.eves@parocltd.co.uk.

[1]. There are six consumer outcomes that firms should strive to achieve to ensure fair treatment of customers. These remain core to what the FCA expects of firms.

Outcome 1: Consumers can be confident they are dealing with firms where the fair treatment of customers is central to the corporate culture.

Outcome 2: Products and services marketed and sold in the retail market are designed to meet the needs of identified consumer groups and are targeted accordingly.

Outcome 3: Consumers are provided with clear information and are kept appropriately informed before, during and after the point of sale.

Outcome 4: Where consumers receive advice, the advice is suitable and takes account of their circumstances.

Outcome 5: Consumers are provided with products that perform as firms have led them to expect, and the associated service is of an acceptable standard and as they have been led to expect.

Outcome 6: Consumers do not face unreasonable post-sale barriers imposed by firms to change product, switch provider, submit a claim or make a complaint.