Our mission at the Academy of Life Planning is to make you happier, healthier, and better equipped to face the future – whatever it holds. So, I’m excited to announce that The Happiness Navigator (or HapNav, as we call it) is live.

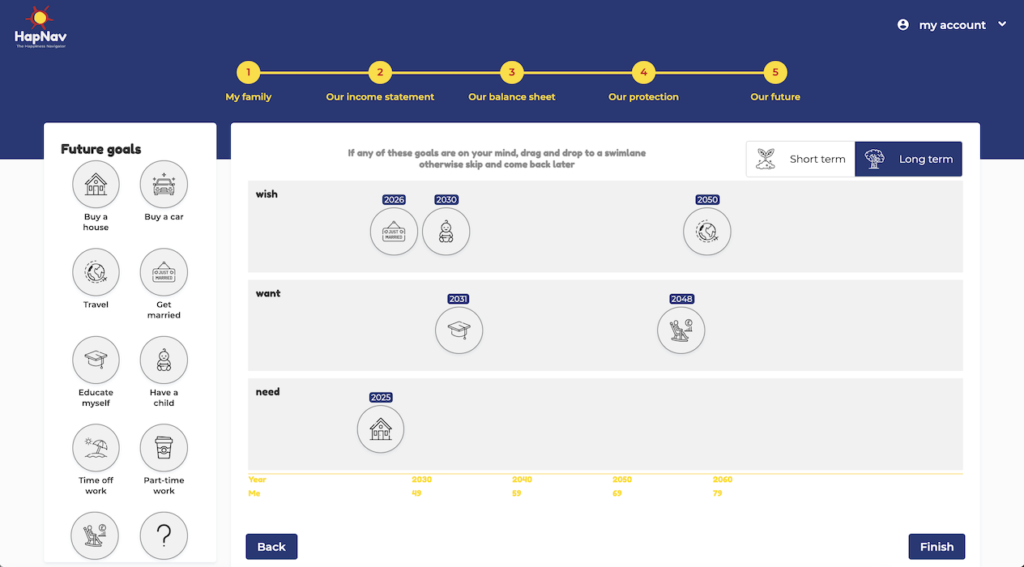

HapNav is a financial planning tool for DIY investors. It’s an intuitive, touch-friendly experience that simulates your family’s financial future to help you navigate life on your terms. In other words, it empowers you to plan your finances and realise your full potential.

How simulation can help you navigate the future

Life is easier to navigate if you have a realistic view of what your future might hold. That means simulating realistic chances of real-world life events. HapNav’s simulation is based on what you tell us about yourself and your family, and other data from trusted sources. We use these inputs to model hundreds of different alternative futures for you.

Simulation is only part of the process. To help you plan for the future, we take the results of the simulation and use them to answer three questions for you:

- Will we be able to do the things we care about in our future?

- If not, why not?

- And – perhaps most important of all – what can we do to fix it?

You no longer need to rely on complicated planning tools provided by banks and asset managers that are simply trying to sell you their products. You own the tool. You own the data. And you’re able to set your own goals based on your own unique circumstances.

Fuelling a movement

HapNav complements Non-Intermediating Financial Planning (NIFP), an incredible movement that’s growing rapidly. Unlike traditional financial planning – which involves huge value leakage via multiple layers of intermediation and fees – NIFP enables people to plan for the future without paying through the nose for it.

This idea is so powerful, we’re building a business around it. Academy of Life Planning (AoLP) is the world’s first global digital support network for non-intermediating financial planners. We’re pioneering the NIFP movement with a disruptive business model that places information at the fingertips of the public. In an asset-biased market where information asymmetry can prioritise the distributor or provider, we’ve decided to put the end user first.

Plugging the advice gap

AoLP is asset-neutral and we don’t seek to manage financial assets for fees. We sell plans, not products. And we place the tools of financial intermediaries directly in the hands of the end user, enabling you to navigate Direct to Consumer platforms and alternative asset management strategies.

Launching HapNav is a crucial part of our vision to change the way financial planning is done. The product is designed for data to be inputted and owned by users rather than intermediaries. And economies of scale achieved by delivering financial planning to groups brings down the cost, making financial planning accessible and affordable for all.

Users can complement the planning tool by attending workshops and subscription models run by Academy members with any number of clients simultaneously, or they can opt to keep data private. By supercharging our disruptive business model with technology, we can plug the global advice gap and help a neglected segment of the population plan for a happier life.

To bring HapNav to market we’ve partnered with Envizage, a London-based fintech that’s reinventing the way people plan for the future. Envizage serves clients worldwide, helping them to engage their end customers so they can achieve better life outcomes.