For a decade or more, the UK financial services industry has been peddling the myth that our pension pots will see us through our later years if only we would save a wee bit more into them. The facts paint a different picture: median pension wealth for 55-64 year-olds is £180,000, over 40 per cent take unsustainable annual drawdowns, over half of all pension pots are extinguished at first access, and nearly three in four pots are taken early, between 55 and 64.

For a couple to meet PLSA Retirement Living Standards, and based on the retirement lifestyle they desire, they would need to save between

£200,000 and £800,000 in their pension. This does not take into account the impact of inflation nor the cost of healthcare and long-term care in later life. It assumes a full state pension. This hypothetical couple would actually need more than these amounts, not less. ONS data shows clearly that most people will not be able to save this much during their working lives, no matter how hard they try.

We need to stop trying to get people to save more, because this alone will not be enough to create a sustainable retirement. Part of the reason why most people switch off when it comes to planning for their later years is because they think they know the answer and they don’t think the problem can be solved. But it can, if we think differently.

To do so, we need to change the framework we use to help people plan their later years. A fit-for-purpose framework must do at least three things. First, it must be holistic; it cannot be just about the pension. Second, it must cope with real-world ambiguity and choices. Third, it must harness complexity rather than ignore it.

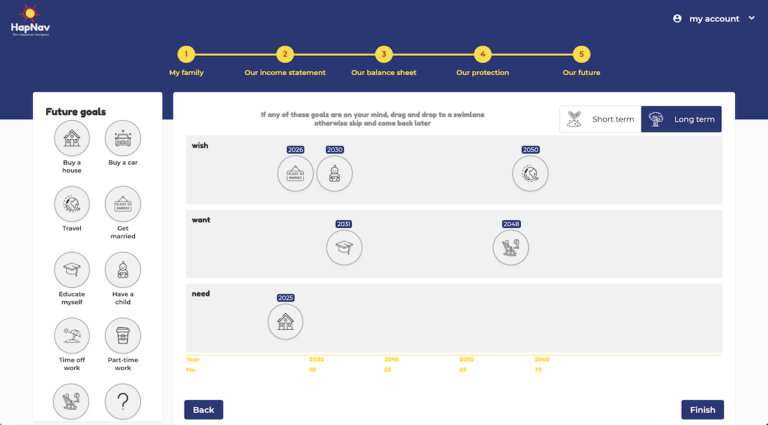

In a holistic framework, the pension is just one of several levers that help people craft a sustainable retirement. It sits alongside other choices and trade-offs: delaying retirement, non- pension financial wealth, equity in one’s home, lifestyle, part-time work, gifts, insurance, borrowing, to name a few. No single lever may be enough, but with small adjustments to several levers, one might plausibly get there. If people know their problem is solvable, more will engage and plan.

Current later-life planning frameworks use outdated simplifications, like the concept of a steady “replacement” income in retirement. Reality is very different – most people’s spending patterns in later life don’t follow a straight line, even before the impact of health and long-term care. People are choosing to retire later whilst life expectancy is into the 90s for people aged 67 today. Against this, most planning frameworks today are deterministic – they assume the future will work out in one particular way and they do not handle ambiguity well. They yield unrealistic answers and provide a false sense of comfort. As John Maynard Keynes said, they are “precisely wrong rather than roughly right”. Our lives and our futures are, on the other hand, not deterministic; they are governed by probabilities of uncertain outcomes.

Solving for a sustainable future, therefore, requires that we consider holistic choices and trade-offs, and match them against a future that is uncertain in terms of both financial outcomes and life outcomes – life expectancy, health, disability and long-term care needs. A decade ago, this was beyond the scope of readily-available computing resources; today it is within reach. Rather than simplifying the complexity of creating a sustainable future for our households, cloud computing allows us to run millions of probable scenarios to identify holistic next best actions that match our personal circumstances. Through human-centric design, it is possible to create digital experiences that tame this massive complexity behind the scenes, yet guide the end user to answers in a simple and understandable way.

If we want people to engage and prepare, we must show them that their aspirations are within reach and focus on what matters to them – the life lived, not the money. We must look at the whole, not the constituent parts in isolation.

We are developing such a realistic framework to help our members reframe their later years and to make the sustainability problem solvable. Our partner Envizage has created a methodology over fifteen years that can handle real-world complexity, yet is capable of powering simple and engaging user experiences. That is a prize worth pursuing.

This article first appeared on Corporate Adviser, 6 April 2021.