In a world full of meaningless buzzwords and hashtags, it can be hard to find phrases that sum up actual solutions, especially in financial services. But here at Envizage, we spend a lot of time thinking about ‘holistic advice’, as we feel it comes close to defining our core offering. We also feel that it differentiates us from the crowded and confusing world of ‘financial advice’.

For too long, and across many sectors (health, wealth, legal, financial to name but a few), advice has been dreamt up and distributed without enough thought being given to the needs of the beneficiary. Holistic advice is different, as it is all about the individual in need.

One thing holistic advice is not is compliance journeys designed to sell financial products. In fact, it’s the opposite. It isn’t about product at all. Rather, it’s about helping people understand their choices and tradeoffs, ensuring that they’ll be able to define, prioritise and achieve the life outcomes that are important to them. This requires a careful consideration of the sources of uncertainty that can cause them not to achieve those outcomes.

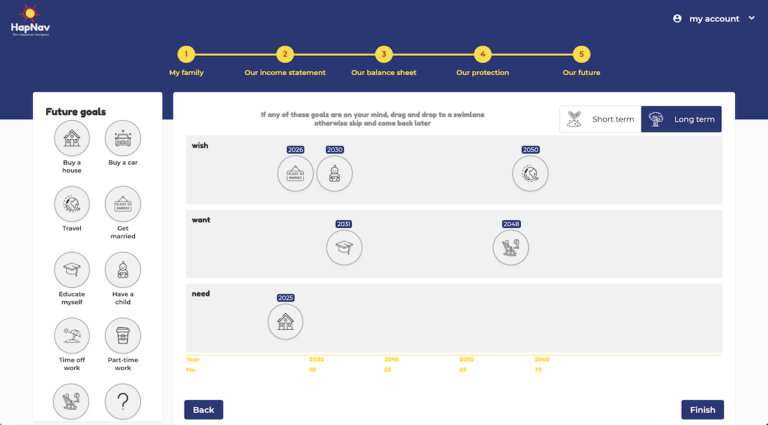

People’s “needs”, “wants” and “wishes” change as they grow and go through various life stages. Consequently, holistic advice must grow with them, changing and adapting to their evolving circumstances. It is not static and binary. It’s dynamic and progressive, changing over time as people change too.

To help people understand the choices and tradeoffs they must make to achieve their desired life outcomes, holistic advice starts by painting a picture of what “today” looks like for a household. This picture should include:

- Who makes up the household?

- What do the household’s balance sheet (assets and liabilities) and income statement (income and expenses) look like?

- Does the household have any protection against life’s nasty twists and turns?

- How does the household define an acceptable future for themselves and their family?

It also helps to answer one key question: what is a “life well lived”? In many respects, it means reducing uncertainty. After all, we humans are animals. We don’t respond well to uncertainty. Holistic advice helps people to navigate uncertainty over the long term.

Uncertainty – and the risks that cause it – can affect a household in a number of different ways. And the very nature of a risk, of whatever magnitude, is that it’s hard to predict yet it has a possibility of coming true. Hence, it’s concerning to see that the majority of financial advice on offer today chooses to ignore most unknowns, or treats them as if they were known.

For example, many advisors and their accompanying technology make binding and binary assumptions, using phrases like, “assume you live to 100” or “assume inflation is 2% year-on-year”. If I knew I was going to die aged 100 and that inflation would be 2% in perpetuity, I’d have no need for advice! Certainty is not realistic. Thus, if you don’t consider the variability and uncertainty of the future, results you present to your clients are nothing short of bad advice.

Further, financial advisory interprets “risk” as investment risk, using stock phrases such as, “an all-equity portfolio is riskier than all-cash” or “your risk tolerance is 6 out of 10”. But people don’t think of risk in this way. For most, risk is a failure to achieve desired life outcomes, which is the biggest risk of all, because we haven’t been advised what to do when we reach that eventuality.

Holistic advice offers a solution to this threat by assessing uncertainty and helping the consumer to understand the answers to three fundamental questions:

- Will we be able to do the things we care about in the future?

- If not, why not?

- How can we fix this?

These may seem like obvious questions, but most of what’s masquerading as ‘advice’ today fails to entertain them. These answers are not inputs and, when you realise this, you begin to understand why there is an enormous – and widening – advice gap. And this isn’t because there is a dearth of advisors or ‘advised’ digital solutions. It’s because advisors, their processes and their technology are designed to answer the wrong questions, ones that most people don’t have.

Take, for example, ‘How much income do I want from my pension pot in the future?’ Few people know the answer to this question, so they depend on crude rules-of-thumb. Most care about their outcomes, whether they’ll be able to enjoy a “life well lived”. Yet, if you don’t take a guess and answer this question, the financial planning process grinds to a halt.

Holistic advice provides solutions to real-world problems and answers questions that people experience in their lives. Its outcomes cover investments and pensions, protection and insurance, and borrowing (the three major financial product families). But it also covers other aspects of life, such as lifestyle, family choices, the role of property, timing of outcomes, liquidity, the role of human capital, education, and much more.

It’s the answers to these crucial questions that make up holistic advice.